And how much money are creators & marketplaces making?

Boston Blockchain Week continued today with a stellar session titled, “Everything you didn’t know about NFTs” — and the panel lived up to its name by providing a wealth of information about the NFT landscape. (For a beginner’s guide to NFTs and crypto, see our NFT glossary.)

What’s striking about the nonfungible token/cryptocurrency space is how transparent the players and stakeholders are. Perhaps that’s not a surprise, given the public nature of blockchain data and the open protocols that power the space. Still, it’s an enormous contrast to the Big Tech landscape that emerged from the Web 2.0 era.

Angela Minster, a data scientist at business intelligence provider Flipside Crypto in the Philadelphia area, shared a raft of publicly available information I hadn’t spotted elsewhere. She got right to the heart of the question:

“How much money are people making with these NFTs?”

The short answer: A limited number of digital creators are making a lot of coin (literally). And nearly all NFT marketplaces are pulling in sales revenue at an eye-popping rate.

SuperRare: Inside the numbers

SuperRare, which I wrote about yesterday, is an online marketplace that hosts generally high-quality NFT artworks that have made it through the startup’s curation process. Creators retain the bulk of their works’ sales proceeds as well as commissions from sales in the secondary market when one of their works is resold.

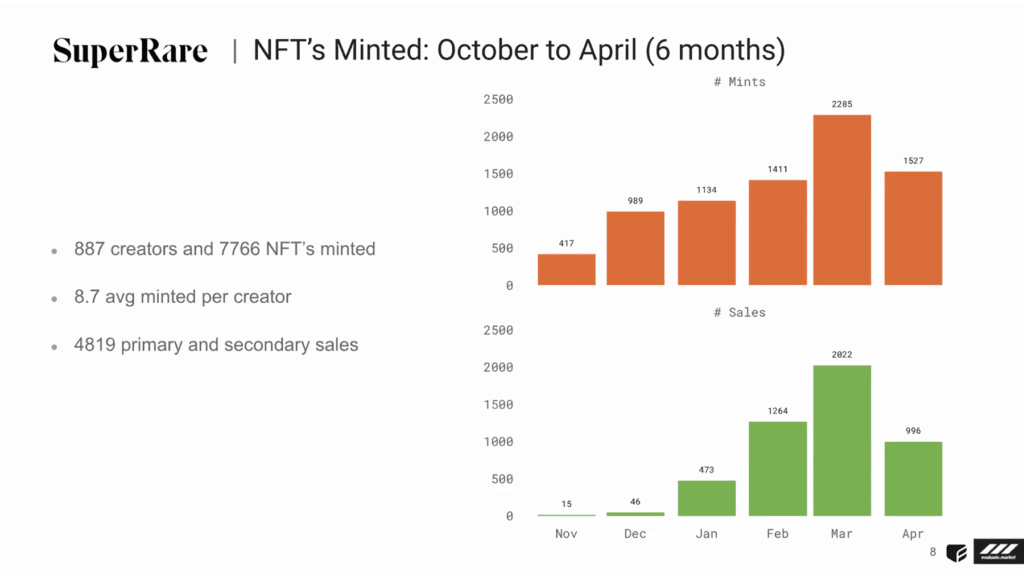

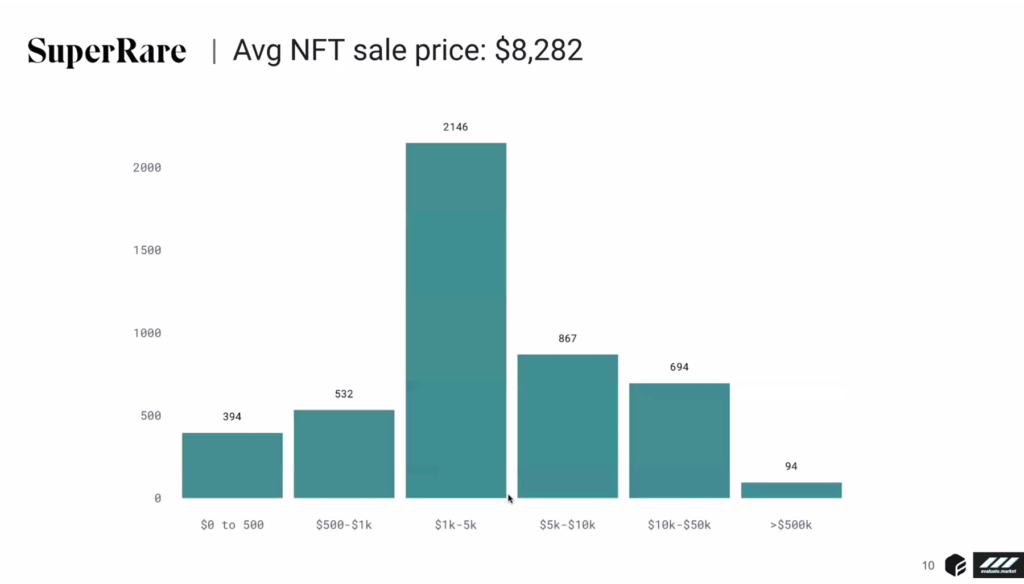

Minster — veteran data scientist that she is — provided public data culled from the past six months (October 2020 to April 2021) so we could see apples-to-apples comparisons. On SuperRare, 887 artists created 7,766 NFTs for an average of 8.7 mints per creator during that span. Of that batch, 4,819 NFTs were sold.

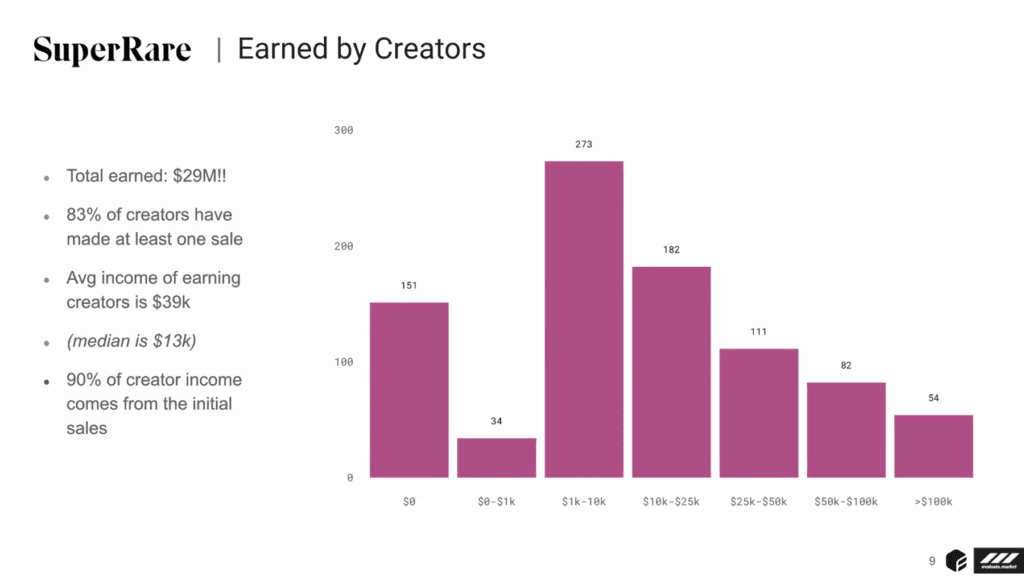

How much did those 4,819 NFTs fetch? “This is crazy. This is amazing,” Minster said. “I think there’s an idea that there’s just a couple of people making a ton of money and everyone else is just wasting their time. I’ve even heard NFTs referred to as a pyramid scheme, which I heartily disagree with. So I think it’s pretty cool that 83% of the creators have made at least one sale.”

The mean take-home for each creator was $39,000; the median take-home was $13,000. So a lot of artists at the top end earned a lot of money, which is paid in Ether, the currency of Ethereum. Fifty-four of the sales earned more than $100,000.

“This is a new economic opportunity,” Minster pointed out. “It’s not like they were making that $39k somewhere else two years ago.”

The other exciting revenue stream is secondary sales. In the real world, if you sell a work of art and then it’s resold, the artist gets nada off the resale. With blockchain smart contracts, creators earn up to about 10% of the resale proceeds. And secondary sales so far make up 10% of the artists’ NFT revenues. “This is brand new,” she said.

While 926 works sold for less than $1,000, the remaining 6,840 sold for more than $1,000 — sometimes considerably more. Ninety-four of them sold for a cool $500,000 or more.

So the early-adopter artists are doing fine on SuperRare. What about the merchant? While artists took home $39 million, SuperRare earned $6 million, or about 15% of what the creators brought home, which seems like a division of assets that pleases everyone. SuperRare charges a 15% cut of primary sales and 3% of secondary sales.

Hashmasks: A different kettle of fish

Minster also ran through the numbers of Hashmasks, which (like Bitcoin and CryptoKitties) has created a business model based on digital scarcity. Launched on Jan. 28 of this year by a group named Suum Cuique Labs in Zug, Switzerland (shameless plug: Zug was a major setting in my novel Catch and Kill), Hashmasks is a digital portrais project run by a collective of artists rather than a startup business.

Some 16,348 individual “hashmask” digital art pieces were sold over a six-day period, netting the artists $13,436,634. Buyers who purchased the works and resold them on Opensea pocketed a total of $36 million, Minster said.

NBA Top Shot: Leading the multimedia NFT charge

Christian Dittmeier, co-founder of the analytics site evaluate.market, ran us through the success story of Vancouver-based Dapper Labs and its NBA Top Shot site, where anyone can purchase short “highligh reel” video clips of NBA game moments. Over the past month, Top Shot has raked in nearly $73 million, selling 1.4 million tokens to 131,553 buyers. The proceeds go to NBA teams and players after Dapper Labs’ cut.

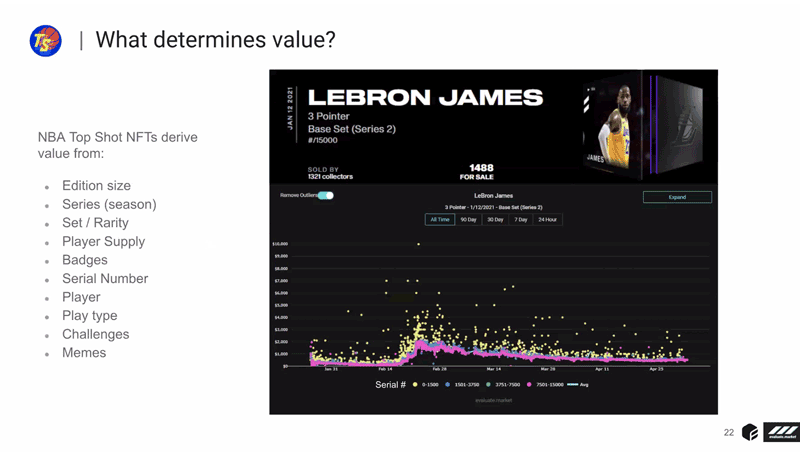

What determines the trading value of an NFT on NBA Top Shot. Lots of factors, Dittmeier said, including the number of cards issues, the series, the rarity of the set, the reputation of the player, the type of play, associated memes and more.

“One thing I think is super interesting about Top Shot and different than my experience buying things on Opensea and other platforms is that you can buy NBA Top Shot moments for as little as $1,” he said. “That’s a little bit more difficult now if the site is more popular but you know the concept of being able to spend $1 plus a 5% transaction fee and have an NFT is kind of incredible. On the marketplace we’ve seen transactions go for as high as $210,000.”

Dittmeier also pointed out that digital collectibles have an advantage over traditional collectible that people spend thousands of dollars on. “With a trading card, there’s a possibility that it’s fake, or there’s damage done to the card or it gets degraded. You have it sent in the physical mail and hope it gets there. So there are a lot of advantages to a digital assets you’re able to display to everybody and you’re able to prove is authentic and that you own it.”

Boston Blockchain Week officials say they’ll provide a summary of each of this week’s sessions as early as next week. Until then I encourage you to check out Flipside Crypto. I just registered, and it looks like they provide a wealth of data analysis tools in a personalized dashboard. All the better to get a handle on this fast-changing landscape.