The web3 community is filled with amazing people who create, build, and inspire. And we’re excited to be publishing a series of conversations with people we’ve interacted with at different events.

Meet Richard Velazquez, co-founder and CEO of Mooch, whom we talked to at Permissionless.

Haley: Hi, I’m here with Richard Velasquez, and we are going to be talking about Mooch. Some more questions that I’m going to ask him to specify exactly what he does at Mooch and his role in the web3 space?

So, Richard, my first question for you is, can you tell us a little bit more about Mooch and why we should all be using it?

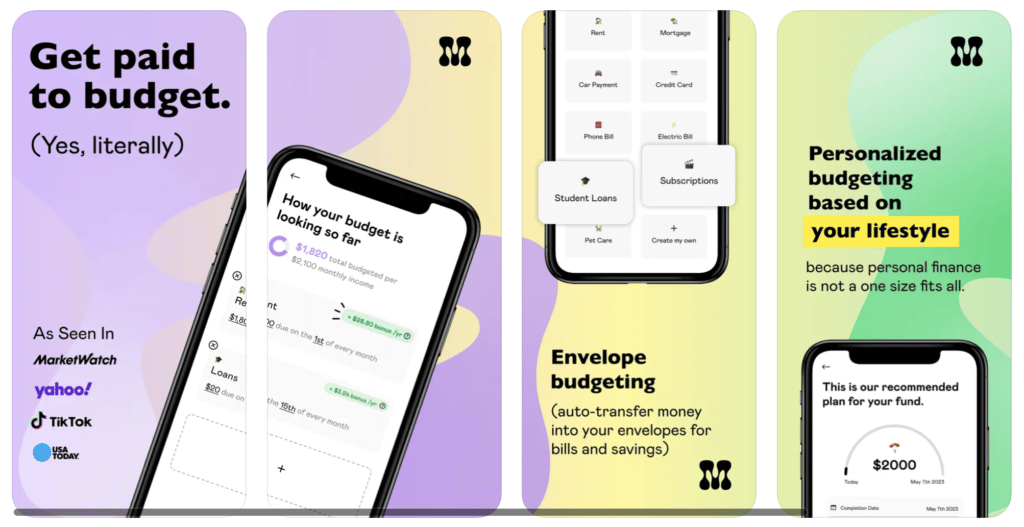

Richard: Mooch is an app that pays you to budget using DeFi. The way it works is you tell us when you’re paid and when your bills are due, and we set the money aside that you should be setting aside to pay those things and put it in DeFi, earning some yields. Then, when you pay your rent on time, or you pay yourself a bill on time, we give you a cash bonus for sticking to your budget. [Using the app] is essentially getting paid to budget.

Haley: Nice! We do have a ton of beginners, so could you explain what DeFi means or what it stands for?

Richard: Essentially, it’s a way to make financial primitives happen without all the middlemen. Right now, if you think of the money in your bank, there are a million middlemen between you and it. They lend it out, they put it in different financial protocols. And why should they have access to that money and not you? You’re not getting any interest from your checking account currently, so instead of doing that, you can interact with the blockchain and get the value from your money. DeFi also stands for decentralized finance.

Haley: It’s perfect, thank you so much for explaining that! My next question is, can you let us know some of the rewards that people get on your platform through their budgeting? How are they rewarded for budgeting?

Richard: Right now, the way it works is you get a cash reward for your budget. So, if you make $100, we call it “envelopes,” you make an envelope for your rent or your new Tesla, or whatever you want to get, you get cash back. We can’t call it interest for regulatory reasons, but it maps to about 2-3% percent APR. [This means] if you set a budgeting goal of, let’s say, $100 for the year, you’ll make about three dollars on that envelope.

Haley: Awesome! You get cashback rewards for your budgeting?

Richard: Yes.

Haley: Thank you so much for sharing! Richard, my next question for you is what is your customer base like, and who is your largest consumer group?

Richard: Our largest consumer group is essentially Gen Z, new professionals. We started off with TikTok. We have 300,000 followers there, and we talk about personal finance and money. We’re really kind of their first step into managing their money after they graduate college or high school. We’re really an on-ramp for them to start with the most basic personal finance principle, which is budgeting. And from there, they can grow into other things like lending or insurance or investing through these different exchanges. We are, kind of, the entry point for your financial life.

Haley: Great! You post TikToks and [other] content, teaching people how to budget?

Richard: Yes, we do videos like with you, like grains of rice and how much money that would add up to, or bottles of water, or things like that to really simplify how finance works, because what we found in the market today is there’s just a lack of

education there. So, to get people all the way to the point where they’re going to interact with DeFi and blockchain. You have to start with the basics, and we start with the basic stuff.

Haley: Who is somebody you think could benefit from Mooch that might not know about it, and do you have a way of reaching them?

Watch the full interview here

Richard: We are @amoochlife everywhere on social media, and it’s really for someone who’s, maybe, just moved out of mom and dad’s place, with their first job, and they’re overwhelmed by the current financial situation of “where should I put my money and why, and we’re an easy place to start. We make sure your bills are paid on time and get you going on that financial journey. Anyone that’s looking for help with their budget would come to us.

Haley: Now, we’re gonna go a little bit into the future. What is next for Mooch, or how do you think it’s going to evolve?

Richard: A lot of our customers, which we call partners, are actually asking for getting rewards in crypto, And what we’re thinking of doing next is letting people get introduced to crypto in a safe way by getting their rewards in crypto or even having our own token. More details on that to come, but that’s where we’re headed.

Haley: You did touch on this a little bit with your TikTok and your Instagram, but is there any other way for people to find you to be able to learn more about personal finance and Mooch?

Richard: We have a ton of educational stuff on our website, which is amoochlife.com

Haley: Richard, thank you so much for letting us interview you and learn more about Mooch! It sounds like a great exciting platform, and I can’t wait to dive deeper into that.

Check the full interview on our YouTube channel

More about Mooch

Mooch is an automatic budgeting app for bills, expenses and savings using digital envelopes that earn cash back rewards on blockchain and DeFi.

Website: http://amoochlife.com

Twitter: @amoochlife

TikTok: @amoochlife

Instagram: @amoochlife

LinkedIn: Mooch company

Image: Sam McGhee via Unsplash