How credit card companies are colluding against MoonPay

In 2005, Wiley & Sons published my first book, Darknet: Hollywood’s War Against the Digital Generation. It detailed an out-of-touch media establishment’s refusal to embrace the oncoming rush of social media, blogging, podcasts and other grassroots media that have forever changed the media landscape.

Here it is 2022, and we have a different cohort of established institutions doing their darnedest to hold back another popular groundswell — only this time it’s cryptocurrency.

Here’s the latest example.

Last week I attended the pre-launch party for Hope for Haiti at NFT NYC. The event was awesome, with beautiful artworks illuminating the popup Superchief art gallery in The Village and speakers from The Giving Block, Civic, Snowcrash (a major player on the Solana blockchain) and a handful of Haitian artists who flew up for the event.

As the even wound down, I chatted with the head of partnerships for The Giving Block and signed up for the pre-release mailing list so tha I could participate in the Hope for Haiti art drop scheduled for June 29. (It’s a terrific collection, with proceeds going to a wonderful cause.)

So far so good.

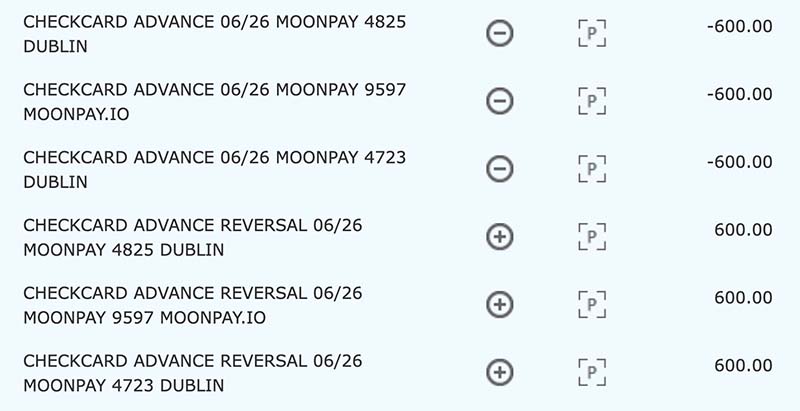

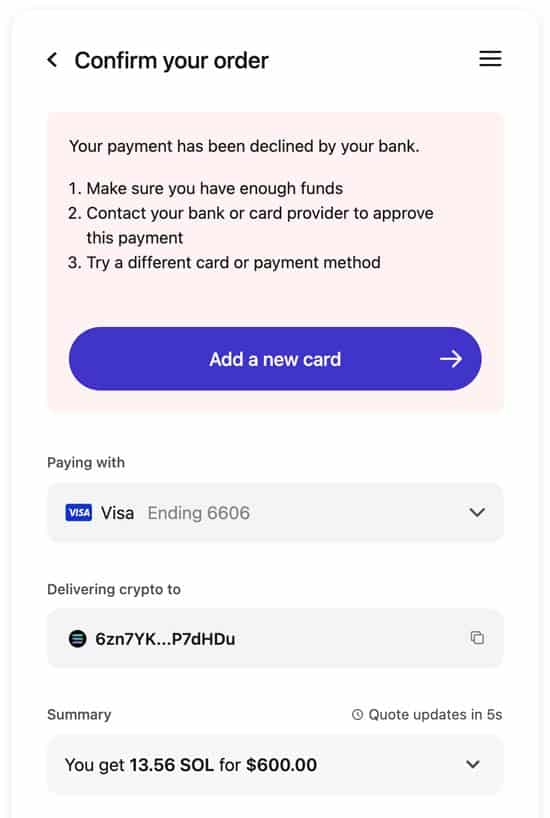

But then came the business of funding my Phantom wallet with SOL, the cryptocurrency for the Solana chain. The price was right — I tried to transfer $600, though to take part in the drop it cost only a bit under $250.

The banks’ unified blockade of MoonPay

We were offered two ways to transfer funds into our wallets: FTX, the major crypto exchange, or MoonPay. Since I haven’t yet set up FTX and i would take a couple of days to fund it through a bank transfer, I figured, I went with MoonPay … whose branding was all over NFT NYC, by the way.

I tried to transfer funds into MoonPay two months ago for another purchase and ran into problems from all of my credit card companies. Surely those barriers were removed for such a worthy cause, no?

No.

I spent the next 75 minutes trying credit card after credit card and bank after bank. Nothing worked – and no reason was given.

Now, MoonPay is not an unscrupulous service, a sinister actor or anything of the kind. If anything, the Miami-based company, founded in 2019, has shown it is as benign as hell. It offers “a fast and simple way to buy and sell cryptocurrencies. Buy crypto with credit card, bank transfers or Apple Pay today.”

Ah, crypto.

Still the bane of big financial institutions.

Here’s what happened. I tried to charge $250 on my Citibank credit card. After a 30-second spinning wheel, the transaction failed. I checked the remaining credit on my card — indeed, of all my cards — and had plenty of credit. So I tried another card.

Chase Visa.

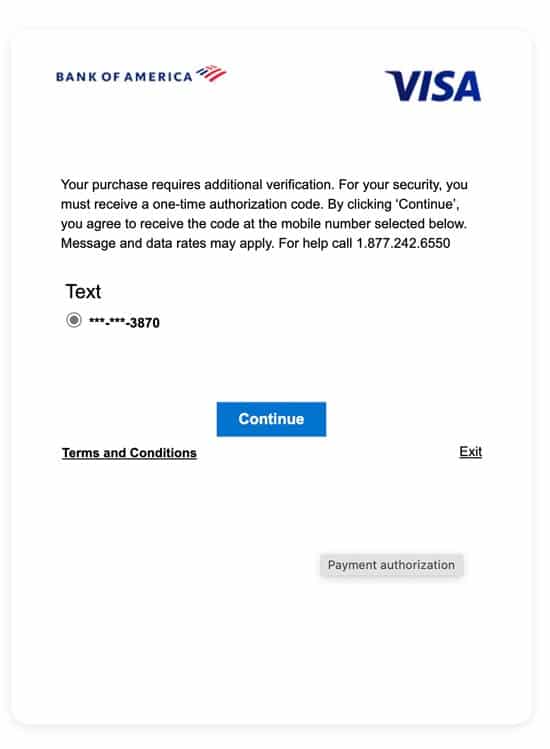

I get a popup, saying the transaction requires additional verification. Reasonable enough.

I receive the text and input the code, approving the transaction. Easy peasy. I go back and try again. This is what I get, without explanation of why I would need to contact a service representative in the middle of the night.

I went on to the next card.

Flagstar? Fuggetaboutit.

World Mastercard? Not on this planet.

How about a debit card? MoonPay helpfully suggested at that point. Users report a 20% higher success rate with debit cards.

So I gave my Bank of America debit card a go.

BofA nearly blew a gasket.

First, it sent me a text to verify the transaction — a smart example of two-factor authentication.

I chose, Yes, I recognize this transaction.

BofA said, Try your transaction again.

I did.

BofA sent me a second text to verify the transaction. I verified it again.

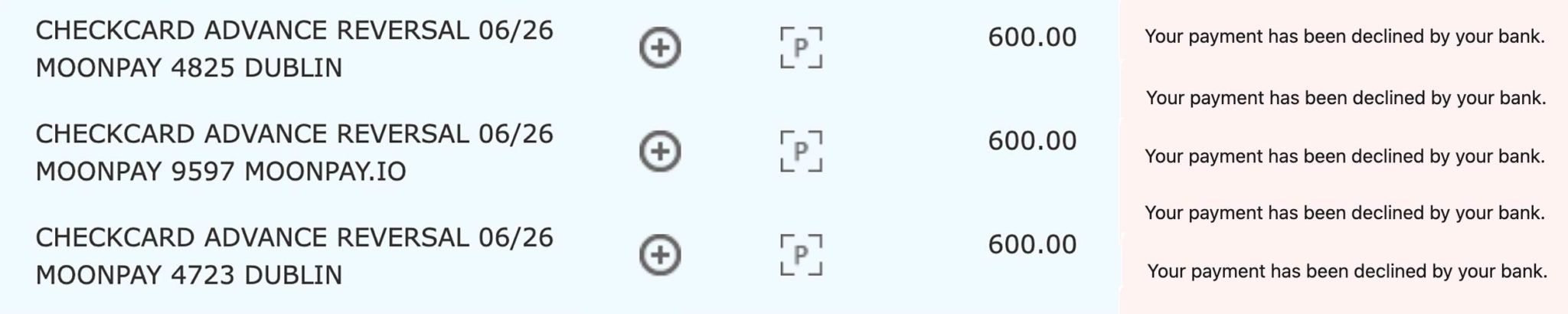

I returned to MoonPay — and the transaction failed again.

Not only that. BofA locked my account because of “suspicious activity.”

After I verified the transaction from the computer and IP address and mobile number that BofA has on file.

Not once, but twice.

The locked account was the coup de grace — nice touch, BofA! I get the message loud and clear:

Try converting fiat to crypto and you’ll pay the consequences.

What arrogance.

Congress ought to take a look at this anticompetitive behavior. So should the Justice Department. Is there collusion here, a violation of the RICO Act? I couldn’ say. But I wouldn’t count on government clamping down on these financial giants.

It will take some time. But I can’t wait for the day these dinosaurs get wiped out by the blockchain meteor hurtling toward them.