Angel investor envisions the future of NFTs & digital art

Third in a series on NFTs: Unlocking the potential of the Digital Economy.

You may not have heard of MetaKovan. But you will. MetaKovan (real name Vignesh Sundaresan) is a Singapore-based blockchain entrepreneur, coder and angel investor who made worldwide headlines last month when he snapped up Beeple’s digital collage “Everydays: The First 5000 Days” for a cool $69 million.

It wasn’t his first digital dance with the artworld, not will it be his last. As the Washington Post reported:

MetaKovan says he purchased 20 artworks by Beeple for $2.2 million in December and decided to make shares of the collection available to the public through a digital token, similar to a share in a company. He created 10 million tokens, called B.20, making around 25 percent of them available to the public. … The B.20 tokens based on Beeple’s work are about 41 times more valuable today than they were in January, when MetaKovan first made them available.

Which is interesting on its own. MetaKovan is clearly not making a statement just about the value of a single piece of digital art but rather an affirmation that the world of NFTs is ready to bust out beyond the still relatively small community of crypto enthusiasts and into the mainstream.

I had never seen MetaKovan on screen until I tuned in to his video chat with famed angel investor Jason Calacanis (disclosure: Jason is a friend) on last week’s Inside.com live-stream “Understanding the NFT Opportunity.”

And what I saw deeply impressed me. Because the Singapore investor is not simply making strategic bets. He’s helping to transform an entire sector.

How MetaKovan sees the NFT space evolving

Calacanis asked about MetaKovan’s investment strategy with regard to NFTs and the art world. Here is part of their conversation.

MetaKovan: Artists are moving on to the blockchain. We have a team of four, at least, who are picking these artists all the time, so it’s not just me. And the other part with the creator program and the grants, what we are thinking is thinking is we need a lot more people to educate the new newcomers into the industry. How do they understand NFTs? How do they start, right?

For example, when I use the word metaverse, it’s a magical word. People have this romantic idea about it, but it’s not true. Anyone can actually visit it. … It’s a very different idea I have. And so I want to create this whole system where there are creators who get supported, and also content creators who are supporting these creators by taking their message and amplifying them.

(In March MetaKovan announced a $500,000 fellowship for ‘‘crypto storytellers’’ funded by his crypto investment firm, Metapurse.)

Jason: When you give that $100,000 grant, what are you getting out of it? Do you get the right to buy their art, do you get their first 10 pieces, or is it literally a gift?

MetaKovan: No, it’s a gift.

Jason: Why would you not have some financial upside of this? If you got to own their first … 10 pieces, and take out half of it, and then because you’re the greatest collector now in the space, wouldn’t that validate them and then you could put them on the market again and get this sort of flywheel going. You seem not cutthroat enough.

“I grew up in a small town in India, and I got the same opportunity to invest in Ethereum as a guy from San Francisco, and I’m like, Wow, this is amazing.”

— MetaKovan

MetaKovan: I really liked how you were speaking to Roham [see my post The unstoppable value that blockchain can bring] and how he was talking about this new world. The artists are getting a lot more important now. I feel that trying to earn goodwill is much better as an asset, and that’s what I’m focused on.

So I will stand in the queue if someone is dropping an NFT. I would never break the queue. [On several occasions] I tried to bid and be part of the auction because I feel like that’s more [important to] the narrative. It creates that move moment where everyone would remember it etc., so if I if I just buy an NFT and put it in my wallet, [I’d have to] explain to you what just happened. So it’s just better to buy NFTs rather than commissioning them, [though] I am commissioning a few pieces.

Jason: To me the most fascinating part about this is the smart contracts and what the downstream economy might look like for these NFTs. Because you saw an emergence of entrepreneurship come out of Airbnb.

MetaKovan: I like what you’re saying here. … Every deal is different. We have no standard deals right now right. Each person on a deal-by-deal basis is how we are negotiating right now. And that’s how it is because we don’t know what’s going to win as a model. So let’s see maybe in six months to a year. I think there’ll be this emergence of a standard of how this relationship could be.

Jason: That’s the amazing thing about open standards, that everybody gets to try what their view is. … I was intrigued about NFTs. And now, after speaking to [the panelists today], I’m really excited about the potential here. What are your thoughts on the grifters and the scammers in crypto and the impact they’re having on sort of making the space look bad?

MetaKovan: Yeah it is the Wild Wild West. And you’re going to have all kinds of players. You cannot regulate away just the bad players. I’ll give an example. Once you started regulating the ICOs, what has happened is that ICOs moved out of the US, and then use only the accredited and the funds in the US to participate in these ICOs, while the rest of the world could [take advantage of deal flow]. So it’s a double-edged sword right. You’re missing the good opportunities, not just the bad ones. … I am 99% in Western crypto at any point.

Jason: Do you own your own home?

MetaKovan: I have no house. I have no car. I have no physical property.

Jason: So if the crypto bubble were to pop like the dot-com bubble, you would literally lose 90% of your net worth.

MetaKovan: Yeah, but that’s OK because my burn rate is like $3,000 a month.

Jason: Promise me you’ll diversify.

MetaKovan: Just keeping everything crypto was not a choice. I don’t come from the US. You should understand that I come from a country where if I had physical property and I was where I was, I might not have that physical property today. I’m from India. … Property rights are is not the same across the world. And that’s the motivation for me to be in crypto right now.

Jason: To you, crypto is less risk. To me, it’s more risk. It’s a really fascinating moment.

MetaKovan: That’s truly America. I’m having goosebumps right now, but I’ve been telling this to people. If America is an idea, crypto is the new America.

Jason: Why?

MetaKovan: Because it’s freedom. It’s freedom and open borders. I grew up in a small town in India, and I got the same opportunity to invest in Ethereum as a guy from San Francisco, and I’m like, Wow, this is amazing. So that’s how I made my money. And the people who started this whole $69 million story, that is also very powerful because it’s a story of crypto more than it’s being a story of just me. Credit goes to a generous industry and credit for the generous people who decided to share a piece of the pie.

NFTs to support a cause

Jason: Any closing comments you want to make or advice for our audience and for the podcast?

MetaKovan: Sure. So a bit about NFTs. A lot of people look at NFTS as an interesting new kind of investment asset, and it definitely is. There’s a lot of risk involved in it, but I feel like there are more angles to it. You could you could be a collector for a cause, you could also put your digital art online to support a cause. And it’s a visual medium. So NFTs are going to hold their value over time based on the community that surrounds it. So, again, this is a huge risk. It’s not like NFTs will make you money, but it’s a nice way to even think about it as a philanthropic thing.

I would urge people, especially the people who made a lot of money in crypto, I urge them to buy art. Take a little bit of your money, and maybe buy a little bit of digital art and make a gallery in the virtual world and hang them. And I’ll come and I’ll come and visit it.

Jason: I love it. … How would you recommend a young content creator start utilizing or investing in NFTs?

MetaKovan: The best place is a virtual meetup called WIP for Work In Progress. It’s the best place to get started and be part of the community.

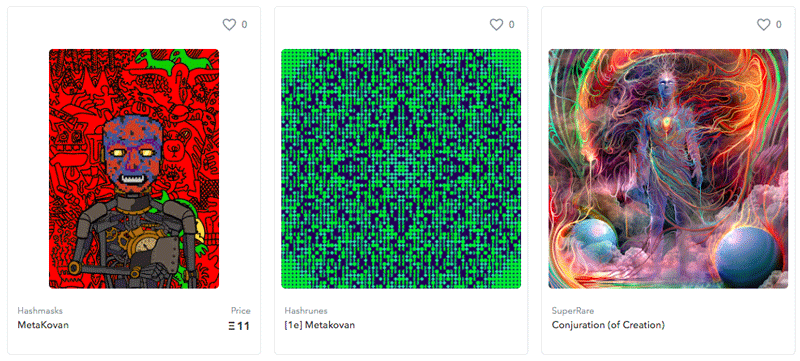

Jason: Where can we see your NFT collection?

MetaKovan: B20.metapurse.fund has all the Beeple collection, so that’s a monument in the metaverse. [The site is sponsoring a $2.7 million “metaverse experiment.”] The other place is OpenSea. You can search, and you will see our wallet full of these digital art collections.

Image at top: Detail of Beeple’s $69 million NFT artwork, “Everydays — The First 5000 Days”