At Digital Culture Works, we place Bankless near the top of podcasts covering crypto, NFTs, blockchain and Web3. And we’ve been spending a good deal of time lately in the Bankless Discord.

So when Bankless came out last week with its list of the Top 20 crypto moments in 2021, we thought it would be worth expanding on them here. We encourage you to catch the episode to get the full flavor of each subject hosts Ryan Sean Adams and David Hoffman tackle. (And if you’re serious about getting a handle on the space, you should subscribe to the Bankless newsletter and podcast.)

Here are the top 20 crypto developments and news stories of the past year, according to our friends at Bankless:

Inflation

We’ll have to agree to disagree with the hosts on this one. David and Ryan argue that there’s now a huge swath of people turning to crypto as a hedge against inflation, and the pair has taken more than a few potshots at the Fed’s monetary policies over the past couple of years as the government tries to save the economy from a pandemic-induced hard crash by printing more money. It remains to be seen how long-lasting the increase in inflation will be, though some inflation was to be expected and shouldn’t be alarming given the deflationary effects of the year-long coronavirus shutdown of the economy in 2020.

A much bigger story that should have made the No. 1 spot was the emergence of crypto and NFTs into the mainstream, raising the public’s understanding of NFTs and cryptocurrencies from near zero name recognition to a considerable penetration of the culture. Digital assets are no longer a fringe discussion for gamers and crypto nerds. Just as hardly anyone had heard of the term “social media” before 2007 before it was on everyone’s lips within a year, the same phenomenon is now playing out with crypto and NFTs.

Inflation? It’s hard to argue that “eth is ultra-sound money,” as David does on the episode, when Ethereum prices fell 16% on a single day in December.

Crypto regulation

More spot-on is Bankless’s spotlight of the provisions slipped into the into the bipartisan infrastructure bill, passed in November, that a set of regulations thar are simply impossible to implement and will lead to more blockchain businesses moving offshore. The new provision expands the tax code’s definition of “broker” to capture nearly everyone in crypto.

But as the Bankless hosts point out, that action has galvanized the crypto community and gotten much more energy and support behind the Blockchain Association, the nonprofit Coin Center and other advocates of cryptocurrency. And members of Congress are speaking up in turn, defending the precepts of digital currency from those who seek to clamp down on the burgeoning crypto and NFT movements. Fortunately, there’s time to reform this provision of the law before it goes into effect in 2024.

Alternative Layer 1s

At the No. 3 spot, the Bankless hosts chose the rise of “alternative layer ones,” that is, blockchains that have risen up alongside Ethereum. These include Solana, Terra ($LUNA), Cardano, Algorand, Hedera, Deso and other layer-one blockchain protocols that have gotten a lot of attention from the crypto community and investors. (By contrast, layer two blockchains, like Polygon and Flow, are more easily interoperable with Ethereum.)

Gas fees

For those new to the space, “gas fees” are the transaction fees that occur when digital currency is exchanged or an NFT is sold. Gas fees have exploded in 2021, and users new to the space are getting sticker shock at how much it costs to buy an NFT if you’re on layer one, the Ethereum mainchain. But that should change in the coming years. As Hoffman put it, “We are in this limbo period, this weird, awkward phase of Ethereum where everyone’s still on layer one and gas fees are really, really high. People haven’t migrated to layer two [side chains connected to Ethereum], but eventually everyone will be on layer twos and they will reconstruct in their in their heads what it means to pay a gas fee.”

‘Ultra-sound money’

The Bankless hosts argue that cryptocurrencies, particularly Ethereum, entered the realm of ultra-sound money in 2020. And as currency exchanges took off and DeFi got built out and ether started being held as collateral by lenders, eth became less speculative and more of a functioning currency for online transactions. The guys get really financially geeky in this segment and you might want to skip over it. Again, eth as a cryptocurrency did quite well in 2021, rising a phenomenal 410% since Jan. 1, 2021. Given the volatility and wild fluctuations in the price and some of the regulatory headwinds and the fact that 99.9% of banks and traditional financial institutions won’t accept Ethereum as currency, though, I’d be hard-pressed to use the term ultra-sound.

EIP-1559

All you need to know is that Ethereum Improvement Proposal (EIP) 1559 — which changed the way transaction fees, or “gas fees,” are estimated — went into effect on Aug. 4. The significant upgrade to Ethereum impacted its supply and was one of the most significant upgrades to Ethereum since the network’s launch.

Constitution DAO

In November, one of the 13 surviving copies of the original United States Constitution sold for $43.2 million in New York. Among the bidders was a digital group that came together and used cryptocurrency to bid on the historic document with the intention of putting it on public display. Even though Constitution DAO lost out in the auction, the grassroots effort captured the imagination of the crypto world and set a precedent for similar actions in the future.

Senate confirms SEC chairman

In April the US Senate confirmed Gary Gensler as President Joe Biden’s SEC chairman. While Gensler appears knowledgeable about crypto, his tenure to date has been a huge disappointment because of the lack of clarity coming from the Securities and Exchange Commission about what constitutes a security. A utility token? An NFT? Your guess is as good as mine. The one thing the sector needs is clear guidelines and that’s what we’re not getting.

Coinbase initial public offering

As the New York Times reported on April 14, “On Wednesday, digital or cryptocurrencies took their biggest step yet toward wider acceptance when Coinbase, a start-up that allows people to buy and sell cryptocurrencies, went public. Coinbase shares began trading at $381 each, up 52 percent from a reference price of $250, eventually closing at $328.28. That gave the company a valuation of $85.7 billion.” Coinbase remains one of the major players in crypto and Web3.

OpenSea goes gangbusters

As NFTs gained wider popularity, the early NFT marketplace OpenSea dominated, taking in more than $10 billion in NFT transactions. Expect 2022 to be flooded with new marketplaces as new technologies and new entrants widen the field dramatically.

Axie Infinity sales reach $1 billion

Axie Infinity, the NFT-based online video game developed by Vietnamese studio Sky Mavis, hit $1 billion in all-time NFT trading volume in August and reached 2 million daily active users in October. The site uses Ethereum-based cryptocurrencies for transactions.

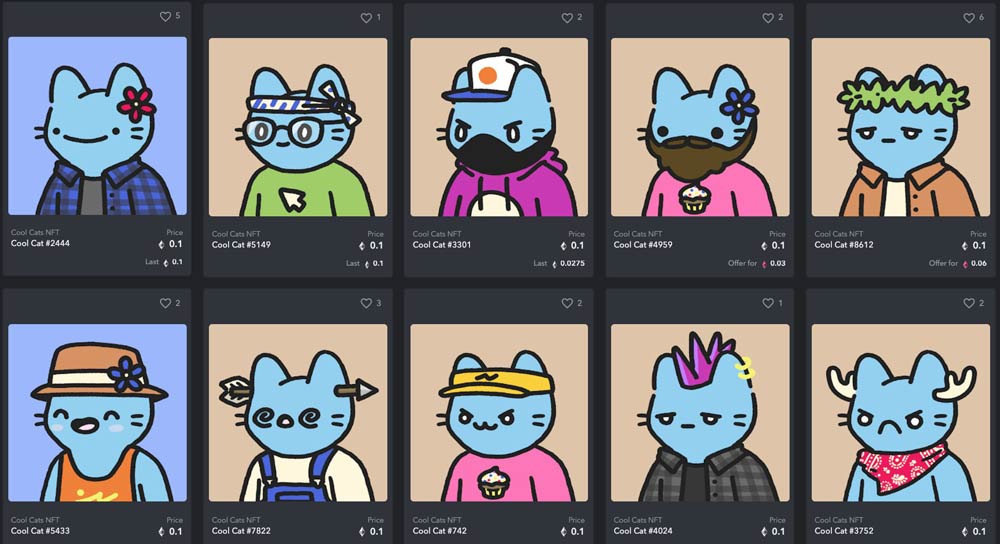

Punks, apes, cool cats and PFPs

The NFT space is in a strange place right now with lots of money being tossed around for a limited supply of NFTs. Among the big winners in 2021 were Cryptopunks and the Bored Apes Yacht Club (the project was released on April 23) and PFP projects — that stands for the slew of Profile Picture NFT projects that typically resulted in a drop of a collection of 10,000 NFTs with a similar theme. Other noteworthy winners during 2021 were Artblocks, the high-end NFT art site, and Cool Cats.

Beeple’s $69 million sale

I would have placed this as the No. 1 crypto news story of 2021, not No. 13, given that it signaled a huge expansion of the crypto world beyond DeFi into a concept readily understandable and appealing to regular people: NFTs. NFTs will overtake decentralized finance in prominence during 2022 — financier Kevin O’Leary believes NFTs will be bigger than Bitcoin, and I agree. Simply put, the artist Beeple’s sale of a single NFT artwork for $69 million ushered in a new era for NFTs and crypto — propelling NFTs into mainstream culture … and even into a skit on Saturday Night Live.

El Salvador accepts Bitcoin

One of the breakthroughs for crypto in 2021 came when the government of El Salvador not only recognized Bitcoin as legal tender but signaled it would encourage its use. Crypto enthusiasts hoped that would lead to a slew of other governments following suit. It hasn’t happened yet.

China ban on mining

China took dramatic steps to clamp down on cryptocurrencies during 2021. The Chinese government banned all crypto mining, trading and exchanges inside its borders, temporarily sending Bitcoin’s price tumbling.

DeFi over CeFi

In February 2021, Uniswap became the first decentralized trading platform to process more than $100 billion in volume — an exciting milestone for DeFi and the sign of things to come, as decentralized finance trading volume surpassed traditional centralized finance trading volume (e.g., on Coinbase) on several occasions.

Rise of layer twos

A whole lot of layer two blockchains and protocols joined the party or grew substantially during the past year. The Bankless guys went into a DeFi rabbit hole without mentioning a single layer two, so I will. Some of the top layer twos — all of which bring different things to the party — include Polygon, the recently launched Arbitrum, Optimism, Loopring, ImmutableX and many others. See some of these blockchain projects at l2beat.com.

Michael Saylor & Tesla

Michael J. Saylor, the American entrepreneur and business executive who co-founded and leads the business intelligence firm MicroStrategy, continued to back Bitcoin in a big way in 2021, with the company plunking down $414 million in additional Bitcoin buys in Q4. When Tesla joined the party and put Bitcoin on its corporate balance sheet before selling it all off later on, some expected other corporations to follow suit. Hasn’t happened in any significant way yet.

GME & memestocks

There was no better example of the power of the crowd than the news that a collection of grassroots investors on Reddit decided to pump the Gamestop stock — first as an effort to rescue the beloved game company and then to push back against hedge fund managers and Wall Street analysts who tried to short-sell the stock. Memestocks, too, had quite the year, with the free-floating Dogecoin trading under a penny a share as the year began, rocketing up to 73 cents per token, and now trading at 17 cents.

Crypto hits all-time highs

Ethereum, Bitcoin and other cryptocurrencies had a bit of a bull run in 2021. Ethereum was up 410% on the year. While the ups and downs of the crypto market likely resulted in a surge of Tums sales, on the whole it’s no longer possible to argue credibly that crypto is a gimmick and that it will all soon go away.

How about you? Any major phenomena or stories in the crypto world that we missed in this roundup? Share your thoughts in the comments below.